The controversial New York City tax lien sale was held Dec. 17, 2021, after months of resistance and rallies from local groups and representatives.

More than 57 elected officials, led by the state attorney general, called on New York City Mayor Bill de Blasio to stall the sale due to the ongoing economic effects of the pandemic.

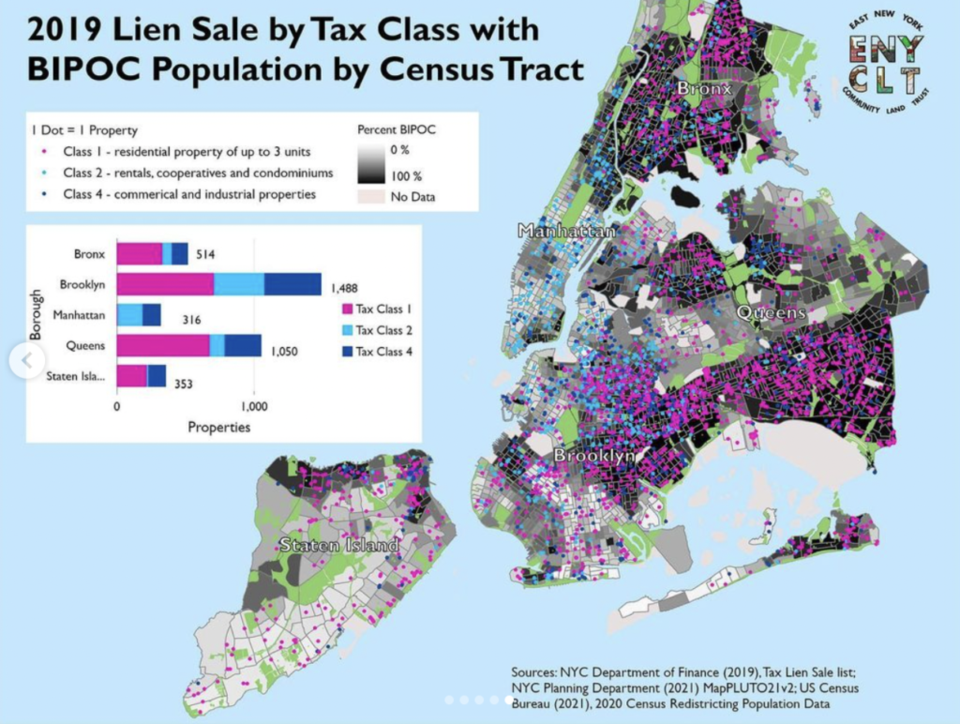

It was not stalled, and the liens of 11,194 properties with outstanding tax and emergency repair payments past-due to the City were put on an at-risk list to be put up for sale to private debt collectors. There were 3,657 one-to-three family homes, 3,295 apartment buildings and 4,242 other properties on the list.

On sale day, 2,841 liens were sold, the Department of Finance said.

The sale will have both immediate and long-term negative impacts on Brooklyn residents, East New York Community Land Trust (ENYCLT) Coordinator Hannah Anousheh said. The trust has been one of the most vocal opponents to the sale.

"We are extremely disturbed that the city went forward with the tax lien sale," she said.

"In doing so, they are putting homeowners who are vulnerable due to the pandemic â" predominately seniors and people of color â" at risk of losing their homes."

The sale list included the liens of 392 vacant lots that could have supported the development of an estimated 3,600 affordable housing units, the trust said. BK Reader has been unable to confirm so far how many of those lots were sold.

"We are in a housing crisis and the city says that there is not enough available land to build more housing yet they are hemorrhaging opportunities on vacant land every year through the tax lien sale," Anousheh said.

What is the tax lien sale?

The lien sale is held every year by the New York City Departments of Finance and Environmental Protection, where the tax liens on properties with unpaid property taxes and water bills are sold off in an auction.

The City sells the liens to a single authorized buyer, who does not take title to the property, but does purchase the right to collect the money owed plus interest and fees â" ultimately multiplying the debt.

If the property owner does not pay, the lien holder may foreclose on the property and the building will be sold at auction.

This year, the Department of Environmental Protection opted out of the sale, which meant it only included Department of Finance-held property tax liens, not water and sewer liens.

The immediate impact on East New York and other low-income BIPOC communities was that homeowners who were already suffering due to sickness, loss and financial hardships would now be forced to pay compounding fees to a private trust and subjected to predatory tactics, Anousheh said.

"Many property owners in this situation choose to sell their homes to investors," she said. "More and more homes in East New York are being purchased by investors and flipped at an enormous profit. Long term residents can no longer afford to live in the neighborhood."

In a recent analysis, the Coalition for Affordable Homes found that of the liens sold in Brooklyn in 2011, nearly half of the one- to three-family homes were sold within five years of the lien sale, compared to 13% of similar properties in the borough during that same period.

What's the future of the tax lien sale?

The trust facilitated the Abolish the NYC Tax Lien Sale Coalition, a citywide coalition of ten member organizations calling for not only the abolition of the tax lien sale, but also the development of an alternative system of tax collection that promotes neighborhood stability through supporting community land trusts.

The tax lien sale law sunsets in February 2022.

The coalition is calling on Mayor-elect Eric Adams and the City Council to "let the tax lien sale die" and work to implement a replacement system.

It has proposed a 7-point alternate system that would either see owners pay off their debts, or resolve the debts through transferring the property to a CLT.

Under the proposal, the CLT would work out an arrangement through which residents who want to stay in place can stay and potentially preserve some equity.