New York City Mayor Eric Adams on Wednesday proposed a plan that would eliminate the city personal income tax for low-income New Yorkers.

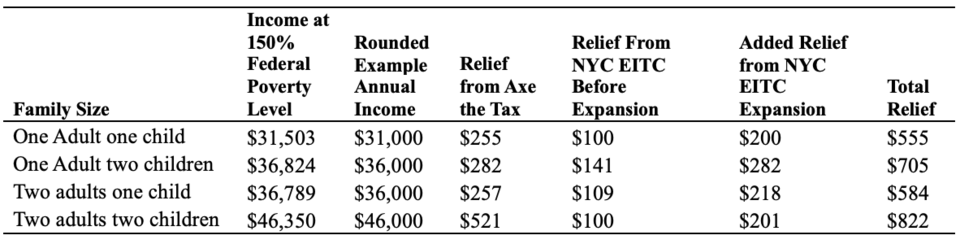

The mayor's Axe the Tax for the Working Class proposal would cut the New York City Personal Income Tax for filers with dependents living at or below 150% of the federal poverty line, as well as lower city personal income taxes for filers immediately above that threshold, according to a press release.

The tax relief will return over $63 million to more than 582,000 New Yorkers, the mayor said.

“Extreme costs are driving many working-class families out of cities like New York, and while, for too many decades, across too many administrations, we let these problems languish, our administration said enough is enough," Adams said. "I did not become mayor just to watch other families struggle the way that mine did, so this money will help more families cover rent, pay for prescriptions and pick up groceries."

The proposal builds on the administration's continued efforts to help put money back into the pockets of working-class New Yorkers, the mayor said. In 2022, Albany expanded the New York City Earned Income Tax Credit (NYC EITC) for the first time in nearly two decades, delivering more than $345 million in tax relief to New Yorkers over the 2023 tax season. When combined, both Axe the Tax for the Working Class and the new, enhanced NYC EITC would put more than a collective $408 million back into the pockets of two million city residents and effectively eliminate New York City income taxes for a family of four making less than $46,350.

New York State Assemblymember Rodneyse Bichotte Hermelyn and New York State Senator Comrie will introduce the bill during the upcoming legislative session in Albany. If passed into law, the tax relief could affect working-class families as soon as tax year 2025.

.png;w=135;h=120;mode=crop)