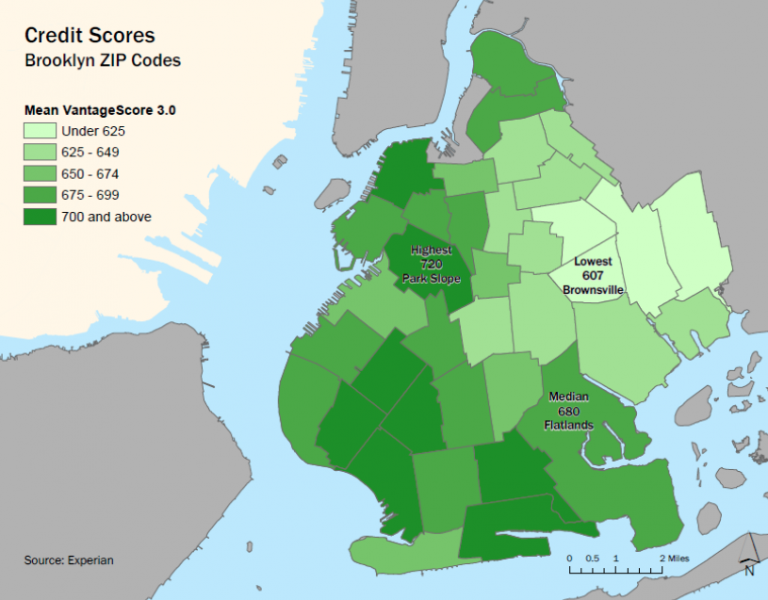

The program allows tenants to add their rent payments to their credit histories; residents of neighborhoods like Brownsville and East New York with particularly low credit scores could benefit greatly from the new initiative

What if you could make your rent count towards your credit score, thereby establish or boost it? The "Making Rent Count" pilot program, launched by Comptroller Scott M.Stringers on Thursday, makes this a reality.

"When it comes to your wallet — credits scores matter. We're facing an affordability crisis, and we all know how soaring prices and sky-high rents make life difficult for New Yorkers across the five boroughs," said Comptroller Stringer. "One of the hidden roadblocks to financial success is credit — and access to it. That's why our new pilot program is so important. It's a model that we want to bring from the Bronx to Brooklyn and citywide so that everyone has access to an opportunity like this. "

In October 2017, Comptroller Stringer's "Making Rent Count" report revealed deep disparities in credit scores across the five boroughs. One in five New Yorkers does not have a credit score and nearly one-third of city residents have sub-prime credit scores. In Brooklyn, residents of neighborhoods like Brownsville, with a median score of 592, and East New York, with a median score of 602, have particularly low credit scores and could benefit greatly from the new initiative.

Renters' credit scores are often penalized by landlords, bill collectors and others when they fall behind on payments; yet they do not see a benefit to their credit scores for paying their rent responsibly. The new pilot project aims to correct that imbalance.

Just like homeowners do for mortgage payments, more than 600 tenants across 27 buildings in the Bronx will now be able to add their rent payments to their credit histories. The Banana Kelly Community Improvement Association, which manages the buildings, has agreed to report rent information directly to the credit bureaus for those who choose to participate in the pilot.

In Brooklyn, one pilot program is already underway: NYCHA is currently partnering with two credit unions, Brooklyn Cooperative Federal Credit Union and Urban Upbound Federal Credit Union, to give NYCHA residents the option to report their credit and to have access to credit building devices.

"To tenants, our message is simple: If you pay your rent on time every month, this pilot could ultimately be a game-changer," said Stringer. "'Making Rent Count' is about bringing people out of the economic shadows and putting the tools of success into the hands of working New Yorkers. And while we're starting in the Bronx, adding rent data to credit reports would bring real dollars to tenants in Brooklyn as well."

The comptroller's analysis predicts that adding rent to credit scores would grant a new credit score to approximately 30 percent of renters for the first time, while it would either raise scores or add additional depth to credit files for 94 percent of participants.

The full "Making Rent Count" report, is available here.